Budgeting apps for Android make it easy to track spending and set financial goals. Most work with bank accounts and credit cards for an all-encompassing view of your financial picture.

YNAB is an easy, user-friendly budgeting app that uses envelope budgeting principles and allows you to assign every dollar a job – whether that means savings or paying down debt. The system links up all of your accounts including checking, savings, credit cards and loans.

Money Patrol

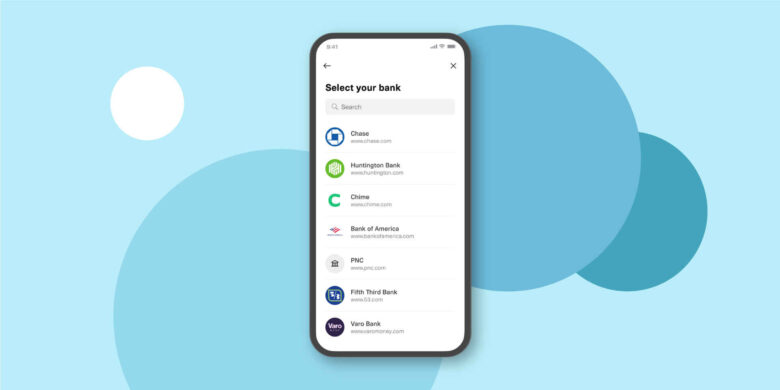

Money Patrol is an app designed to help you manage your budget effectively. It connects to multiple banks and credit cards and sends alerts about spending habits across them all, as well as bill reminders to stay aware of upcoming due dates and help set automatic savings goals. Furthermore, this system comes equipped with 256-bit encryption PIN access security as well as Face ID for added protection.

Empower Personal Dashboard, formerly known as Personal Capital, is another outstanding budgeting app. It links your bank accounts together and allows you to track spending, income, investments, debts, loans and more; even providing a net worth tracker and breakdown of your investment portfolio! Available both desktop and mobile devices.

Before selecting a budgeting app, determine your priorities and which features are most essential to you. For example, if syncing with financial accounts is key for you, select an app with bank-grade encryption and multi-factor authentication. Other features to look out for are customizable expense categories, mobile-friendly interface, support chat feature as well as customer reviews to see if any users have experienced bugs or glitches with software.

YNAB

YNAB app is an ideal way for those who wish to track their spending and make informed choices regarding how they use their money. It features budget categories, alerts when your expenses exceed your allocated budget in any area, reports and charts that help create accurate financial picture.

One feature that sets YNAB apart from many other budgeting apps is its “intentional honesty” with your money. It displays your bank balance at the top of the screen, while expense categories reflect how much is actually available – for example if you budget $100 for Christmas this year but only end up spending $100, that category will remain yellow until that amount appears in your account – an invaluable reminder that spending is only supposed to happen with what’s already there and gives a greater control over spending habits.

Although YNAB is free, its premium subscription option grants users access to additional features, including being able to sync bank accounts and import transactions automatically from them. In addition, this version also features a secure read-only API connection which keeps hackers at bay so your bank information stays protected and safe.

Zeta

Zeta is a money management app designed specifically with couples and families in mind. It can work alongside or replace existing accounts to help manage shared finances as needed. Features of Zeta include shared spending account, savings goals and bill payment automation – plus it has no monthly fees or minimum balance requirements! Furthermore, Zeta also features tools designed to help save for vacations, home renovations or emergencies.

Zeta stands out from other apps by providing full banking services via its partnership with Piermont Bank, including an actual debit card along with all its features and features like same-day ACH transfers and access to an in-app concierge.

Zeta may be an efficient way to manage finances, but it may not suit every user. Due to limited functionality compared to other budgeting apps, some individuals or couples may prefer individual or joint accounts that offer greater rewards. Furthermore, keeping up with updates and features may prove challenging; luckily Zeta’s team are always adding features designed specifically to aid couples’ finances.

Mint

Mint has earned itself a strong reputation among budgeting apps for providing users with an array of features. Users can connect their bank and credit accounts, enabling them to monitor spending and savings; categorize transactions over time; view credit report summaries 24/7; as well as receive alerts if suspicious transactions take place in their accounts.

Key features of this app include its ability to remind users about upcoming bills and payments, making it easier for them to remain financially organized. Furthermore, the app offers a detailed breakdown of expenses as well as identification of areas in which savings goals may be set more easily while keeping records of savings and investments.

Mint is an invaluable tool for monitoring spending, yet falls short when it comes to forward-looking budgeting. The premium version of Mint provides spending projections based on past behavior which can help determine how best to allocate remaining monthly budget. Furthermore, this feature lets you see whether goals are realistic and can be accomplished within given timelines – it should be an essential feature in any budgeting app!